Mortgage insurance provides eligible. Cmhc defines the benchmark rate as the chartered bank conventional mortgage 5 year rate that is the most recent interest rate published by the bank of canada in the series v121764 as of 1201 am eastern time each monday.

Canada S Prime Rate Drops To 3 45 Ratespy Com

For the first time in almost three years the bank of canada has lowered its five year benchmark rate.

What is benchmark rate in canada. The bank of canada cut its benchmark interest rate by 50 bps to 125 percent on march 4th 2020 bringing borrowing costs to the lowest since june 2018. A new benchmark rate for insured mortgages will replace the bank of canada 5 year benchmark posted rate in determining the minimum qualifying rate stress test. The benchmark rate made headlines in the early part of 2010 when the government of canada announced new rules for lending money and qualifying for mortgage loans.

Department of finance canada news release. Minister morneau announces new benchmark rate for qualifying insured mortgages. Canadas framework for government backed mortgage insurance supports a stable housing market.

Todays bank of canada qualifying rate. The finance department announced tuesday it will set up a new benchmark interest rate used to determine whether people will qualify for an insured mortgage that will be based on actual borrowing. Since 30 march 2015 thomson reuters benchmark services limited has been responsible for the calculation of the corra rate.

This rate as calculated by thomson reuters is published by the bank at the end of the day. The benchmark rate is a rate that lenders are required to use to qualify mortgage borrowers in canada who want a variable rate mortgage or a mortgage term of less than 5 years. 12 month per cent change.

The bank of canadas five year benchmark is the rate at which canadian borrowers are. Today minister of finance bill morneau announced changes to the benchmark rate used to determine the minimum qualifying rate for insured mortgages also known as the stress test. Policymakers said that the economy has been operating close to its potential with inflation on.

It is the first time since march 2009 that the central bank slash rates by 50bps following us feds decision to lower rates by the same margin.

The Big Question Isn T Whether The Bank Of Canada Will Raise Rates

Everyone S Mortgage Is About To Get More Expensive

Virus Rate Cut Could Open Poloz S Bank Of Canada Finale

A Brief History Of Interest Rates In Canada Tembo Financial

Bank Of Canada Holds Benchmark Interest Rate As Economic Growth

Posthaste Td First Big Canadian Bank To Cut Mortgage Rate In

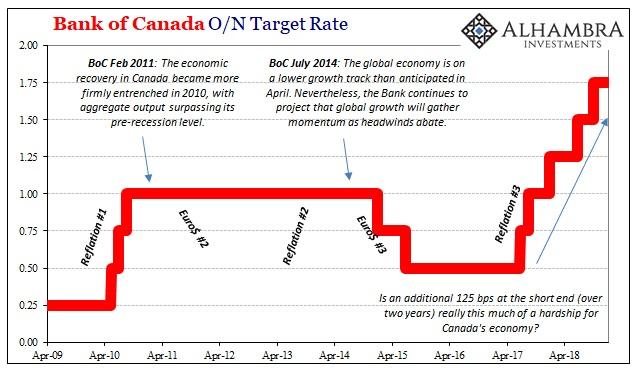

Canada S Fallacy Contribution Seeking Alpha

Bank Of Canada Raises Benchmark Rate To 1 Bloomberg

Bank Of Canada Holds Interest Rate Steady Hints Low Rates Could

No comments:

Post a Comment