Mortgage insurance provides eligible. Osfi maintained the benchmark rate in its minimum qualifying rate to address public consultation feedback which highlighted the value of including a floor and called for greater alignment with the government of canada minimum qualifying rate for insured mortgages which uses the same benchmark rate.

Mortgage Stress Test Changes Coming Morneau Announces In Move

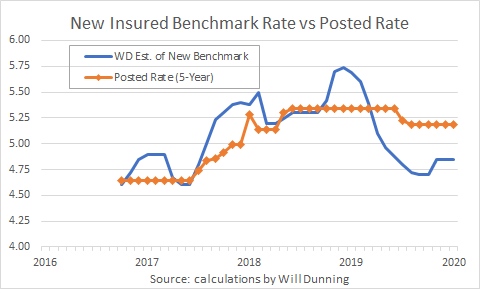

The new benchmark rate will be the weekly median 5 year fixed insured mortgage rate from mortgage insurance applications plus 2.

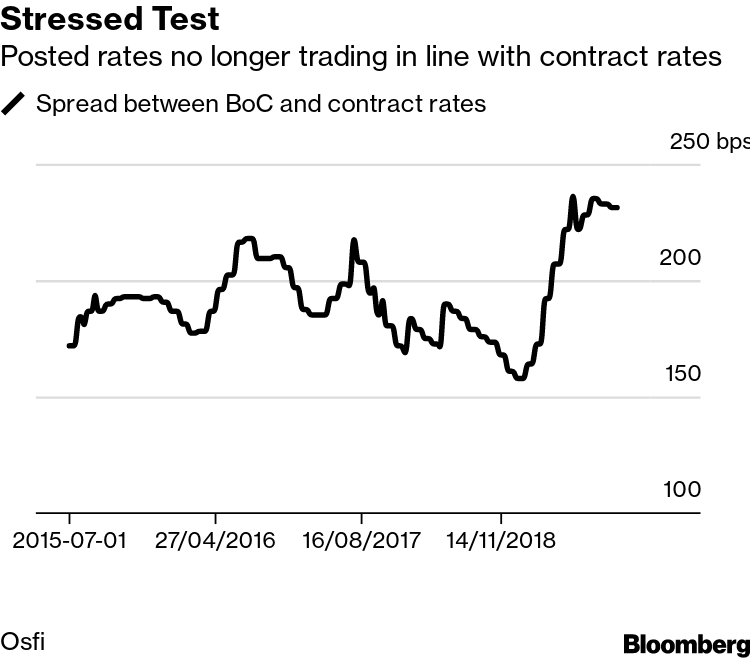

New benchmark rate for insured mortgages. Osfi is seeking input from interested stakeholders on this proposal before march 17 2020. A new benchmark rate for insured mortgages will replace the bank of canada 5 year benchmark posted rate in determining the minimum qualifying rate stress test. The finance department announced tuesday it will set up a new benchmark interest rate used to determine whether people will qualify for an insured mortgage that will be based on actual borrowing.

Osfis mortgage underwriting guideline b 20 sets the minimum qualifying rate for uninsured mortgages. The new benchmark rate will be the weekly median 5 year fixed insured mortgage rate from mortgage insurance applications plus 2this follows a recent review by federal financial agencies which concluded that the minimum qualifying rate should be more dynamic to reflect the evolution of market conditions better. Osfi is seeking input from interested stakeholders on this proposal before march 17 2020.

The office of the superintendent of financial institutions osfi has announced that it is considering a new benchmark rate to determine the minimum qualifying rate for uninsured mortgages. Today minister of finance bill morneau announced changes to the benchmark rate used to determine the minimum qualifying rate for insured mortgages also known as the stress test these changes will come into effect on april 6 2020. The proposed new benchmark for uninsured mortgages is based on rates from mortgage applications submitted by a wide variety of lenders which.

This rate is also the new benchmark rate for insured mortgages as announced today by the minister of finance following consultations with osfi and other federal financial agencies. Canadas framework for government backed mortgage insurance supports a stable housing market. The office of the superintendent of financial institutions osfi has announced that it is considering a new benchmark rate to determine the minimum qualifying rate for uninsured mortgages.

The new qualifying rate will be the mortgage contract rate or a newly created benchmark very close to it plus 200 basis points in either case. The change which will take effect april 6 2020 means borrowers with insured mortgages typically those with less than 20 equity will need to prove they. The federal government announced on tuesday it will be changing the benchmark qualifying rate used for canadas insured mortgage stress test.

Morneau eases stress test on insured mortgages minister morneau announces new benchmark rate for qualifying for insured mortgages.

Tweaking Stress Test Rate Doesn T Use All The Tools Available

Mortgage Brokers Are Hiring Like Mad As Home Loan Rates Plunge

New Benchmark Rate For Qualifying Insured Mortgages Global

Mortgage Stress Test Changes Coming Morneau Announces In Move

Canada Relaxes Mortgage Qualification Rules As Rates Fall Bloomberg

Waiting For Ester The Road Ahead For Interest Rate Benchmark Reform

Departmentoffinance Instagram Posts Photos And Videos Picuki Com

Mortgage Stress Test Changes Coming Morneau Announces In Move

Have Questions About The New Stress Test Rate Here Are Some

No comments:

Post a Comment