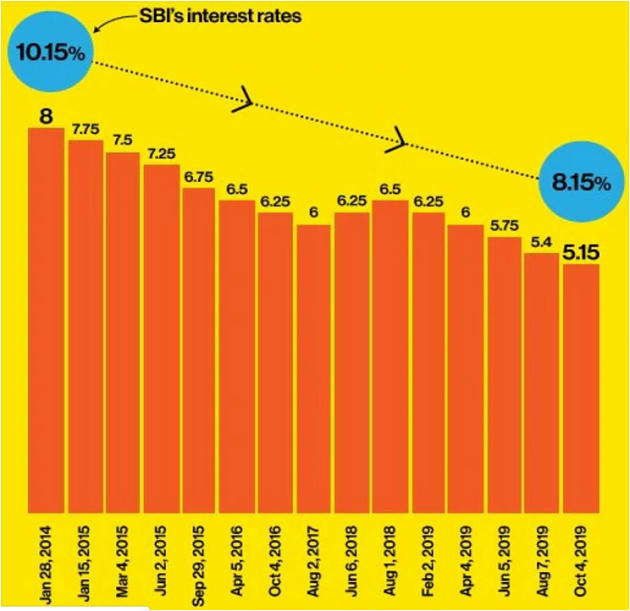

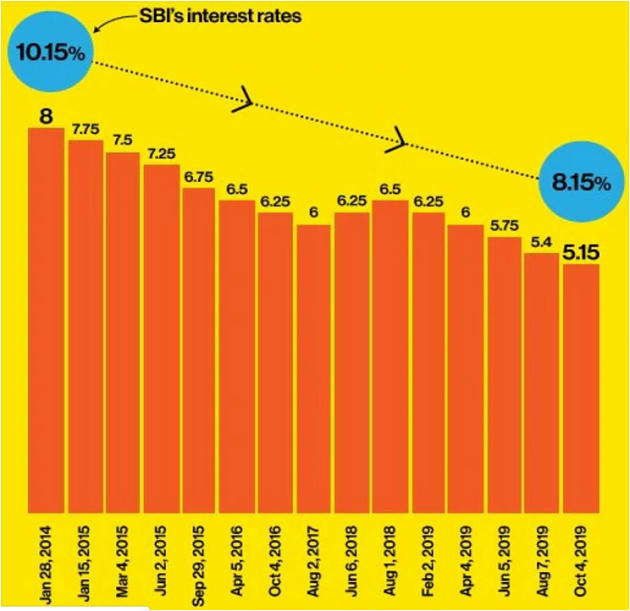

In the april 2012 june 2013 period while repo rate came down by 125 bps banks deposit rate fell by just 40 bps. Personalretail loans loans to msmes to an external benchmark with effect from 1 st october 2019.

External Benchmarking Of Loans Manifest Ias

The rbi has made it compulsory for banks to link their new floating rate home auto and msme loans to an external benchmark from october 1 so that the borrowers can enjoy lower rate of interest.

External benchmark rate rbi upsc. Significance and the rationale behind rbis move. External benchmark rates. Banks may be advised to facilitate existing loans to shift to new benchmark without any conversion fee or any other charges within one year of its introduction.

The rbi has given these options to. What is the current practice. Sbi cuts external benchmark rate by 25 bps.

Most commercial banks in india are likely to select rbis repo rate as the external benchmark to decide their lending rates from april 1. All loans such as for car and home disbursed from april 1 2016 are linked to marginal cost of funds based lending rate. Under the new system which will come into effect from april 1 2019 banks will have to link their lending rates with an external benchmark instead of mclr.

The marginal cost of fund based lending rate mclr is currently the benchmark for all loan rates. Under the rbis new external benchmark framework banks will be forced to lower lending rates even if they have no relief on the cost front. Currently interest rates on loans are linked to internal benchmarks.

What does the rbi move mean for you banks will have to link interests to external benchmarks instead of internal ones which is the current norm. Rbi 6th bimonthly monetary policy 2019 20 mpc keeps repo rate unchanged current affairs 2020 upsc duration. The repo rate is the key policy rate of the reserve bank of india rbi.

The reserve bank of india rbi has proposed linking the interest rates charged by banks on loans to the external benchmarks. Banks can choose from one of the four external benchmarks repo rate three month treasury bill yield six month treasury. Rbis policy repo rate.

This will hurt margins. Linking interest rate to external benchmark. It has been recommended that all floating rate loans extended beginning april 1 2018 could be referenced to the selected external benchmark.

The move is aimed at faster transmission of monetary policy rates. The reserve bank of india has made it mandatory for all banks to link all new floating rate loans ie.

What Is External Benchmark Rate Free Pdf Download

Editor S Take Rbi Move To Link Loans To External Benchmarks To

Why The Repo Is Not A Suitable External Benchmark The Hindu

Monetary Policy In India Objectives Framework Committee

Mrunal Upsc Reserve Bank Of India Money Supply

New Policy For Overseas Borrowings Current Affairs Today

Repo Rate Unchanged Drishti Ias

Will External Benchmark Rate Be A Reality

External Benchmark Rates Drishti Ias

No comments:

Post a Comment